When a shortage of coin prevented him from paying his troops, Jacques de Meulles—the administrator of the French colony of New France—resorted to using playing cards. Thus in 1685 the Western world’s first paper money was created. De Meulles only intended his playing card money to be a temporary back-up to specie. When coin arrived in the next boat from France, he promptly redeemed the entire issue. But over the years, Quebec’s administrators would resort to ever larger amounts of playing card money to meet citizens’ demand for cash.

Little did de Meulles know that hundreds of years later, his paper-money invention would be serving as a different sort of back-up system. Banks and credit card networks are processing a growing proportion of society’s transactions. These financial institutions are privy to an ever-expanding slice of our lives. Do we trust banks to do a good job guarding this information? Perhaps they may accidentally allow hackers access to it, or they may be forced to give the government a quick glance at what we’ve purchased over the last month. Cash, on the other hand, leaves no trace of what we’ve bought or sold. No other payments medium allows us to be 100% sure that our personal information can never be seen by someone else.

Not only does cash protect our data, it provides us with irrevocable access to the payments system. Electronic payments systems are run by central authorities with the power to censor users. In 2010, for instance, Bank of America, MasterCard and VISA embargoed Wikileaks, effectively cutting it off from receiving payments. Or consider the case of UK-based NGO Interpal. After it was accused of terrorist financing by the U.S. government and sued by families of the victims of bombers, Interpal accounts at a succession of UK banks were shut, despite the fact that the Charity Commission for England and Wales—a government department that regulates registered charities—cleared the NGO three separate times of the accusations.

More recently, U.S. banks have been unwilling to open accounts for marijuana firms. Even though many states have legalized marijuana sales, federal law continues to treat marijuana as a drug on par with heroin. Like Wikileaks and Interpal, the marijuana industry has been able to fall back on cash to survive. Cash is decentralized. Banknotes move from hand to hand rather than requiring permission from a central processor. The advantage of this is that there is no third party that can insert themselves between two willing transactors and prevent them from consummating a deal. In a sense, cash is society’s payments-system-of-last-resort.

U.S. dollars are not only used by Americans but are also a popular means for foreigners to protect themselves from inflation of the domestic currency. The most marked example of this is Zimbabwe. In late 2008, with inflation hitting 79,600,000,000% per month, Zimbabweans spontaneously threw their Zimbabwe dollars into the trash and started buying and selling things with U.S. dollars. The economy’s galloping price level suddenly came to a halt.

U.S. banknotes are also popular in countries with corrupt banking systems. In early 2016, lineups began to grow outside of Zimbabwean banks as locals tried to withdraw banknotes. Lacking enough reserves to meet these requests—a large chunk of the banking system’s resources had been confiscated by then-leader Robert Mugabe—the banks began to set strict daily withdrawal maximum of around $30. By late 2016, all deposits would be unofficially redenominated. Sadly, this meant that any Zimbabwean who had funds stuck in the domestic banking system had had a significant chunk of their wealth stripped from them. Those who held their wealth in U.S. dollar form preserved their purchasing power.

Zimbabwe’s example illustrates how the U.S. dollar serves as the world’s backup monetary system. When people’s wealth is arbitrarily threatened by those in power, U.S. banknotes serve as an escape hatch.

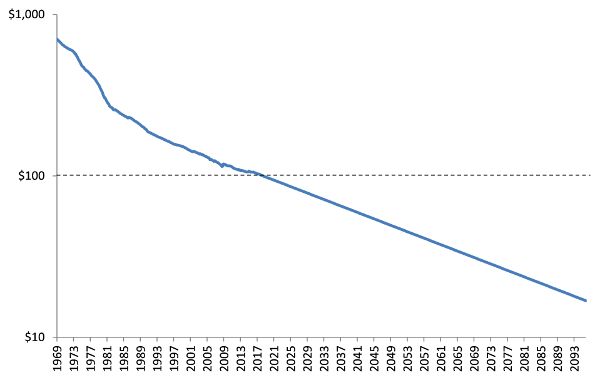

The ability of U.S. paper money to provide censorship resistance, data protection, and to act as the globe’s back-up monetary system has steadily declined over the years. Low-denomination banknotes like the $1 and $5 are excellent for providing small amounts of the above services. But to enjoy larger flows of these services, $1s and $5s are too bulky—higher denomination must be brought into service. Here’s the catch. Inflation has been eating away at the purchasing power of the U.S.’s highest denomination banknote, the $100 bill. Back in 1969, one $100 could buy 700 dollars’ worth of 2018 goods. Put differently, in 2018 it takes seven bills to do the work of just one.

Figure: Real value of the $100 bill, log scale

At inflation rates of 2% or so, by 2047 the $100 bill will buy as much as a $50 bill does today. By 2090, it will be capable of purchasing the same amount as today’s $20, and a hundred years from now its purchasing power will be the same as a modern $10 bill. That’s right—in 2118 the highest denomination note would be good for just two big Macs.

Introducing a new supernote, say a $500 or $1000, would stabilize this trend. With a new highest denomination banknote, U.S. cash would be able to provide society with the same convenient data protection that it did in the past. And by reducing the monetary workload that cash users must endure, a supernote would continue the U.S. dollar’s long tradition of providing both Americans and foreigners with a low-cost alternative to those who have been censored or face the threat of wealth confiscation.

If there are good arguments in favor of a new supernote, there are also good arguments against it. In his 2016 book The Curse of Cash, Kenneth Rogoff ignited a fiery debate by calling for an end to high-denomination banknotes. Rogoff’s refrain has been taken up by others, notably Peter Sands, a former bank executive, and economist Larry Summers.

There were some 12.5 billion $100 bills in existence at the end of 2017, or thirty-eight $100 bills per American. This simply doesn’t reflect the personal experience of most citizens. Indeed, 2012 survey data shows that consumers generally report holding just $56 per person. This number is bloated by the large amount of U.S. currency circulating overseas. But even in Canada, which does not issue an internationally accepted currency, there are thirteen $100 Canadian bills outstanding per citizen, far in excess of the amounts that most Canadian keep in their wallets or their cookie jars.

Proceeding from this observation, Rogoff reasons that high denomination banknotes are primarily used by criminals and tax evaders. By removing these denominations and forcing criminals to rely on smaller denominations like the $5, Rogoff contends that crime would become a less profitable endeavor. As for tax evaders, they would be pushed into the formal economy. This, he contends, would be beneficial for government finances. With less tax evasion, government revenues would rise.

The current U.S. policy of allowing the purchasing power of the $100 bill to wilt rather than introducing new higher denomination notes is a drawn-out version of what Rogoff advocates. Instead of cutting the highest denomination note’s purchasing power in one fell swoop, this same effect is occurring slowly via inflation. Rogoff would oppose the introduction of a new supernote for the same reason that he calls for a ban on the $100. A new supernote, say a $1000 bill, would be a boon to tax evaders and organized crime. According to Peter Sands, $10 million one-hundred dollar bills weighs 10 kilograms, an amount that a drug dealer could fit into seven briefcases. Using $1000 notes, that amount would fit into one briefcase with plenty of room to spare. Avoiding taxes by paying a contractor in supernotes would be easier too.

A number of arguments have been mounted against Rogoff’s proposal. William J. Luther, Larry White, and Jeffrey Rogers Hummel have all pointed out that much of the goods and services that are exchanged in the informal cash-using economy occur between consenting participants and do no harm to third-parties. This includes goods and services like prostitution and marijuana. Just because high-denomination banknotes help facilitate these activities does not necessarily mean that society would be made better off if these notes, and the trade they facilitate, were not provided.

James McAndrews contends that if high-denomination banknotes were to be removed, organized crime networks might launch an effort to create an underground payments system of their own. Without recourse to the courts, the mob would use force to manage this system. So by ceding the anonymous high-value payments business to criminal enterprises, the central bank would actually be responsible for increasing the amount of violent crime in society rather than reducing it. McAndrews’s criticism focuses on a “one fell swoop” scenario in which the $100 and $50 are removed. But assuming the United States refuses to issue a new super note, and inflation continues to eat away at the value of the $100, the scenario he criticizes will emerge with time.

These objections somewhat reduce the appeal of crime suppression as a motive for quashing high-denomination banknotes. That leaves tax evasion. Tax evasion creates equity problems. For instance, if contract workers can evade their taxes by accepting banknotes but an otherwise equivalent salaried employee cannot, the salaried employee bears the burden of making up for the tax gap caused by the contract employee. This hardly seems fair. A supernote would only increase this inequity. Cash-induced tax evasion can also lead to economic distortions. A project with high returns might lose funding to a low-return project only because the latter can avoid being taxed thanks to greater reliance on cash sales.

If there ever was a tough balancing act, this may be it. Providing civil society with consistent levels of censorship resistance, freedom from data snooping, and a fully functioning back-up monetary system are all important. But these services will inevitably be abused.

But there may be a way to provide a new highest-denomination note while also developing a mechanism for coping with some of the negative externalities created by that note. The idea is to tax the new note.

This may come as a surprise, but banknotes are already taxed, albeit not explicitly. Anyone who holds a $1 bill is forfeiting around two cents per year in interest. This tax could be removed if the Federal Reserve paid interest on banknotes (say in the form of a serial number lottery), or if it set nominal rates at zero so that owners of notes needn’t lose out on any interest. Although notes are taxed, this hasn’t hurt their popularity. In the U.S., the quantity of banknotes in circulation continues to grow at 6.8% year, in line with the 35-year average growth rate of banknotes and well above nominal GDP growth.

The current tax on banknotes is a flat tax. Owners of large denomination $100 notes pay the same tax rate as owners of small denomination $1s and $5s. This doesn’t seem fair. If illicit usage of notes becomes more prevalent as the denomination of notes rises, it makes sense for the tax rate on high-denomination notes to be higher than that on low-denomination notes. Under this tax regime, those engaged in the sorts of illicit activities facilitated by high denomination notes will also bear the costs of the externalities they create.

It is relatively easy to set a higher tax on supernotes than on other denominations. Say that an extra 5% surcharge is deemed adequate to offset the externality caused by supernote users. On the first day that the supernote is issued, the Federal Reserve sets the value of the supernote at $1000. It does so by promising to redeem all supernotes with $1000 worth of other notes and/or electronic reserves. On the second day, it reduces its redemption rate by fifteen cents, to $999.85, and the day after to $999.70. By the end of the first year, the supernote would be worth around $950, fifty dollars less than its initial value.

The effect this has is that anyone who had held one thousand $1 bills over that period would have been taxed at the regular rate of about 2% per year, or $20 in real value. But anyone who had held the supernote would be taxed not only the $20 but an additional $50. This $50 would be used by the government to plug the hole caused by supernote-facilitated tax evasion and the extra work required on the part of law enforcement officials.

To get the Federal Reserve’s exchange rate for the supernote on any particular day, people could simply check the Fed’s website. To make things less complicated, the Federal Reserve could print the new notes without a denomination, just like how medieval coins were issued. The new note would be nicknamed the (Susan B.) Anthony, or the Lincoln, or whomever, depending on whose face was printed on it.

The tension between the important services provided by the highest denomination note and the potential for those properties to be abused make this issue especially complex. The monetary authorities have currently settled on a “Rogoff-lite” policy of slowly reducing the ease of accessing the vital services provided by U.S. cash. As time passes and inflation eats away at the $100, the risks of reducing the convenience of the array of U.S. banknotes will grow. A supernote, one that bears an extra tax relative to other banknotes, is one option for settling some of these tensions. It ensures that U.S. paper money continues to provide the same services as before while also trying to capture a toll from abusers.