About this Issue

Can economic growth continue forever? If not, what can stop it?

These questions are simple to ask, but their answers are momentous. Past answers have varied tremendously: Will we run out of fertilizer? Or timber? What about rare elements? Will we grow overpopulated and outpace the food supply? Or will climate change bring a lasting economic reversal?

What if there were no truly insuperable limits to growth in our near future? Yes, all things must come to an end, but it might still be that we’re nowhere near it. If so, failure to grow could have more to do with public policy and other social conditions, and much less to do with physical necessity.

Our lead essayists this month, the Cato Institute’s Marian Tupy and Brigham Young University at Hawaii’s Prof. Gale Pooley, are among the optimists. They suggest that we live not in an age of growing resource scarcity, but in an age of superabundance—the term that they use for a situation in which the growth in material abundance outpaces the growth in human population.

Still, it should not be forgotten that rapid economic growth is an unusual situation in the history of the world; for most of recorded time, growth was either negligible or glacially slow, and it came with frequent reverses. It might be more plausible to expect that growth will return to the mean—which would suggest that rapid growth of the type we’re experiencing now isn’t likely to last.

On this view, natural limits are likely to reassert themselves, and indeed, these limits may already be discernible. Our panel of response essayists this month includes Dr. Katherine Trebeck of the Wellbeing Economy Alliance, who will be writing with Prof. Dirk Philipsen of Duke University, as well as Prof. Giorgos Kallis of the Institute of Environmental Science and Technology, Barcelona. Each takes the view that natural resources pose genuine, near-term limits to economic growth.

Following the formal response essays, we will feature a discussion in which all participants may ask questions of one another and reply; comments will also be turned on throughout the month so that readers may join the discussion.

Response Essays

Why Malthus’s Gospel of Growth Was, and Still Is, Wrong

Marian L. Tupy and Gale Pooley tell the story of the Simon-Ehlrich wager that Simon won because metals got—and kept getting—cheaper. There is little to disagree with—just three reservations.

First, as my Berkeley mentor Richard Norgaard (economics PhD at Chicago, with Milton Friedman curiously) showed, prices say more about the beliefs of the investors who buy commodities than about long-term physical scarcity.

Second, prices also depend on (un)fair trade, labour/environmental protections, military/geopolitical power, and paying, or not, the social/ecological costs of extraction.

Third, and to joke, a bigger population means more innovators solving old problems, but also more evildoers creating new ones.

But yes, Ehrlich was wrong about looming shortages and famines. The question is: is this relevant today? I am not sure.

The problem now is not scarcity, but damage. The UN’s International Resource Panel finds that resource use is responsible for 80% of total global biodiversity loss. Impacts at extraction sites are causing hundreds of local conflicts, met with violence.

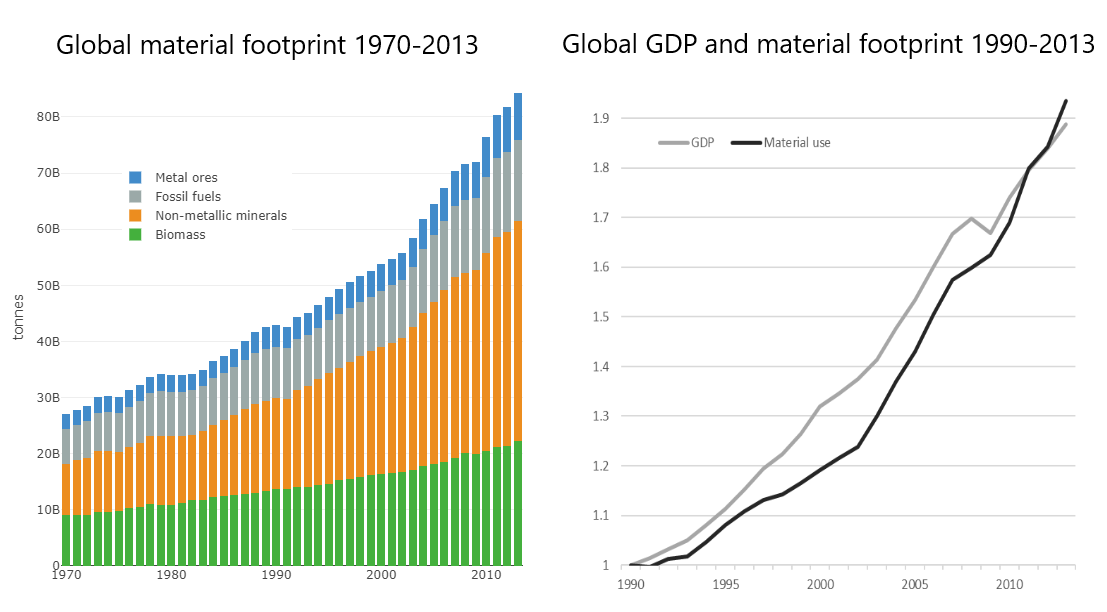

Resource use grows hand in hand with GDP (Figure 1), even in service economies like the US or the UK where economists expected reductions (Figure 2). And resource cost fell—and extraction increased—because of fossil fuels, which cause climate change.

Figure 1.

Climate change has been a problem for forty years now. Against Simon’s prediction that we “can forever continue to respond to … existing problems,” there is no progress in reversing global emissions. If you feel upbeat about climate mitigation because Simon won the wager, then you may trust someone who foresaw the LA Lakers championship of 1985 to tell you the winner of the 2024 elections.

Figure 2.

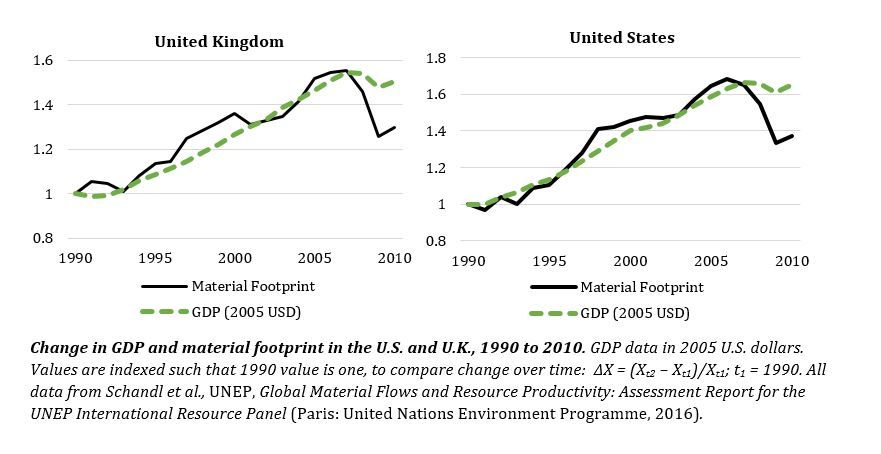

Clean energy technologies advance, but according to optimistic projections the world is bound to 3 or more degrees Celsius increase by 2100, triggering abrupt changes. The higher the GDP, the higher the carbon emissions (Figure 3). Climate modelers square economic growth with a safe climate by assuming unproven and untested “negative emission” technologies in the future (such as tree plantations two to three times the size of India absorbing and storing carbon dioxide from air); and by positing unrealistic increases in energy efficiency. Some countries like the United States or the United Kingdom have decreased emissions while growing, but nowhere near the pace necessary, and partly thanks to slower GDP growth since 2008.

Figure 3.

Economists no longer think that climate breakdown will cause just a small dip off a much higher GDP. A lesson from the—miniature in comparison—pandemic disaster is that ecological-economic disruptions are unpredictable and far-reaching. Countries that took the costs of decisive action early on the pandemic have functional economies now. This seems a more relevant lesson than that of the wager. The issue is not whether there are limits to growth, but how to slow down growth now to live well tomorrow.

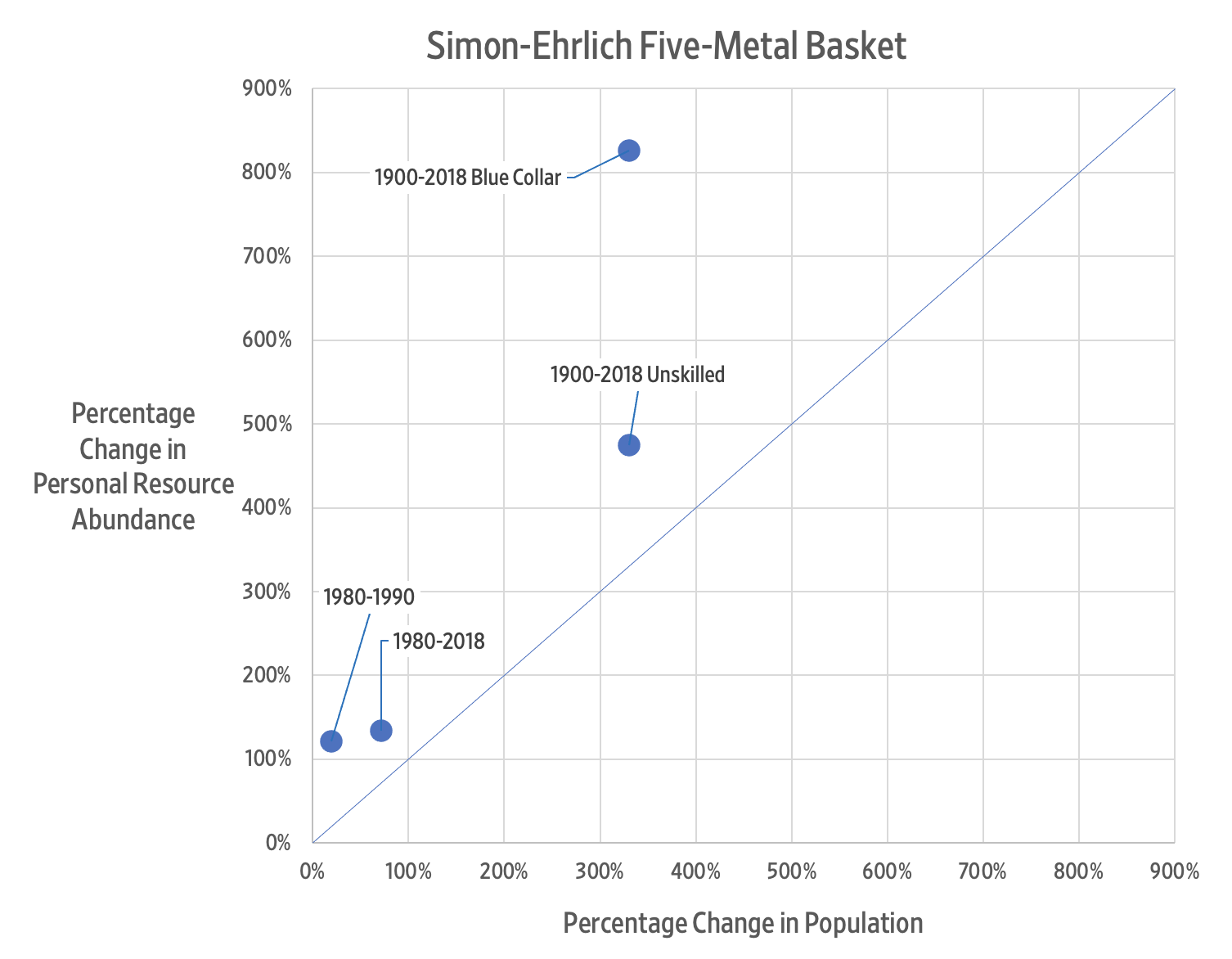

Come to think about it, the expectation that economies must grow at a compound rate is weird. 3% growth each year means a global economy, big as it is, 10 times bigger by the end of the century, straight towards infinity (Figure 4). As Aristotle pointed long ago, money gives the illusion it naturally grows at the interest rate lent. But something—the environment, debt, insufficient demand or investment outlets—will check infinity.

Figure 4.

In fact, over the past two decades many high-income economies have experienced a great slowdown. Dietrich Vollrath argues that this is actually a sign of economic success—it’s the product of high living standards, reduced population growth, and a shift to services, where productivity growth is slower.

The problem is that to rekindle growth, governments sacrifice living standards. Not only by destabilizing the climate, but by exploding private and public debt—Quantitative Easing inflating assets, increasing cost of living and cutting public services on top. Growth has become uneconomic; its costs exceed its benefits.

On-going research studies how to manage without growth by reducing the working week, changing money creation, reducing inequalities, or paying a universal income, perhaps funded by a carbon dividend. These are not easy policies. But prosperity without growth is the defining challenge for twenty-first century economics, and better ideas are welcome.

In my book Limits: Why Malthus Was Wrong and Why Environmentalists Should Care, I argue that the 1970s debate between cornucopians and neo-Malthusians is past its sell date. Let me diverge, explaining my rereading of Malthus, because it is relevant.

Malthus’s intellectual biographers show how Malthus was much more of a cornucopian than his neo-Malthusian heirs. In the Essay on Population Malthus claims, like Tupy and Pooley, that we can produce as many commodities as we demand. Unlike Ricardo, Malthus did not see diminishing returns in agriculture. Land produce can grow with no limit, he wrote. For Malthus population growth was the greatest good for a nation. He was against birth control or helping the poor, because he wanted a cheap, excess labour to grow production—the only viable way he saw for growing population closer to the “natural” geometric rate.

Malthus was a cleric and did not put bets, but his prediction was correct. Well, his was not a difficult prediction. Malthus predicted that population cannot grow geometrically—something will check it. Indeed if global population doubled every 25 years from 1 billion in 1800, it would be 500 billion today. But voluntary controls did check it, and Malthus was aware that people could control their numbers. What Malthus got totally wrong instead was that he regarded such voluntary controls as unnatural and repugnant. Voluntary limitations are as painful as famines and plagues, Malthus wrote, because God wants us to work and populate the earth, not idly enjoy its fruits (hence his opposition to birth control).

This gospel of growth, by a cleric who became the world’s first professional economist, has been with us ever since. Malthus was writing about an unlimited drive for reproduction; economics after him instead talked of an unlimited drive for consumption, or more generally “utility”—which requires more and more production, though always falling short of satisfying our unlimited wants. Scarcity and growth then are two sides of the same coin. The cornucopians and the neo-Malthusians are closer to one another than they think.

Yet there is an obvious third possibility—limiting ourselves to avoid scarcity and disaster, and living well with what we have. For lack of a better a word, and being provocative, I and others call this “degrowth”—slowing down so as to live better.

Voluntary limitation is a freedom not to. Freedom rests on limits; think of the canvas a painter needs to paint. Limiting yourself in one aspect liberates you in another (stop smoking and you can now run). Economists, like Malthus, are wrong because people do limit their wants all the time without suffering as a result. Freedom, the classics taught us, is the power to live within one’s own means; mastering is to be content with enough. True freedom cannot be freedom gained at the expense of others’ freedom (say, the freedom of future generations to live on a liveable planet).

You may object here, like Malthus, that limiting growth is tyrannical. But it’s not, if that is what we democratically decide to do. There is nothing natural in compound growth; indeed, most human civilizations had no experience of—or word for—that condition. The idea of continuous growth is relatively recent, a product of the New Deal, when GDP was invented to help governments manage the economy. The Soviets first set annual growth targets in the 1950s, with the OECD following on and kick-starting an era of “growthmanship.” Growth is now like a secular god, a doxa whose truth cannot be questioned, left or right, east or west.

Compound growth started before it was named, with the Industrial Revolution in England. As Sven Beckert’s history of cotton shows, freedom of enterprise, science, and innovation were one part of the story; the other was cheap raw material from slave plantations in the Americas, and the brutal destruction of India’s artisanal silk industries by the British, creating markets for their excess cotton. The material benefits of growth to masses of working people in the West, and now in the East are undeniable—so is the fact that this depended and depends, on keeping the labour and resources of others cheap, by force if need be.

Degrowth is therefore addressed to the Global North, not impoverished countries that need to industrialize and produce necessities. The good news is that satisfactory levels of wellbeing can be achieved at a fraction of the highest national incomes. Costa Rica for example has among the highest life expectancies and wellbeing in the world, at less than one-fifth of the U.S. income. There is no strong case for the Global North to keep growing so as to pull the South out of poverty; not growing on the back of the South would be enough. Right now, for every $1 of aid the global South receives, they lose $14 through unequal exchange with the North.

To close: I fully agree with Tupy and Pooley that a future of abundance is possible. Unlike what Malthus claimed, we have inherited a generous planet, which can remain abundant if we limit our wants within what it has to offer, sharing its fruits fairly. Humans are wondrous, intelligent, imaginative beings, always experimenting with diverse ways of living and of organizing their societies. A monoculture of GDP growth stifles the freedom to choose alternative paths. As disasters proliferate, not for the first or last time in human history, I remain optimistic that societies can transform for the better. Malthus was wrong to think that we cannot limit our wants and change our ways - especially when we finally face with a clear head the consequences of not doing so.

From a Harmless Bet to Russian Roulette

The lead essay by Marian L. Tupy and Gale Pooley represents a fascinating, if narrow, historical story. Augmenting the data used in the Simon-Ehrlich bet is a useful addition to understanding price trends. But those, projected into the longer term, hit inevitable obstacles. That projection is based on improbable assumptions about the human ability to invent itself out of the basic laws of physics. It violates the precautionary principle, and it downplays our embeddedness in ecological systems. Above all, their vision of the future seems unambitious.

The conversation helps illuminate a central debate of our times. Shall we continue to follow past wealth creation and place faith in inventiveness based on markets and monetary valuations? Or shall we take a broader perspective that acknowledges the enormous costs of wealth production and values life beyond the marketplace? As scholars who readily acknowledge that a certain level of output is necessary for the common good, we offer the idea of a Wellbeing Economy as an agenda which speaks directly to a richer view of progress and flourishing.

Beyond the Bet: Are Markets Really the Preeminent Mechanism?

We begin where we agree. Markets represent an effective, and in some circumstances quite possibly the best, mechanism to determine how to get goods and services to people in an efficient and cost-effective way. Tupy and Pooley’s implicit celebration of human ingenuity is on point, as it is one of the most hope-inspiring qualities of humanity. The two—markets and ingenuity—are not unrelated. We also know that Tupy and Pooley share our concern for poverty alleviation, or, more broadly, our hope for a world in which everyone enjoys a high degree of wellbeing and the kind of freedom that offers real choices.

Beyond these agreements, our assessments begin to diverge. For example, the authors assume that a basic mechanism—the market— is unrivalled in negotiating human prospects. This may well be true for basic goods and services, but it demonstrably fails for everything not traded in the marketplace—freedom, creativity, meaning, community, a healthy environment. Reliance on markets also assumes that free markets actually exist, but markets are only as good as the mechanisms (rules, regulations, laws, enforcements and so on) that make them possible. Moreover, markets are constantly under threat from large corporations trying to eliminate market competition in their pursuit of private gain and the socialization of costs.

Even under ideal conditions, markets can never provide the good life itself. At best, they are a means, not an end. As the former Governor of the Bank of England Mark Carney acknowledged: “Commodification, putting a good up for sale, can corrode the value of what is being priced…Putting a price on every human activity erodes certain moral and civic goods.” For some products (such as those which pollute or make us sick or less safe), having more reflects uneconomic growth, as it generates more costs than benefits. Think of costly retreats for lost community and friendship; expensive vacations for lost access to nature; cars for lost safety and possibility to walk or bike; or home security systems for lost neighborhoods where people looked out for each other.

The question that matters is not growth versus no growth, but progress toward the common good versus harm to people and planet. This demands we inquire about what we mean by “growth”—surely, in the words of Nobel Prize winning economist Amartya Sen, trying “to capture a complex reality in one number [like GDP] is just vulgar.”

Beyond the Five Metals and Growth as a Goal

The account Tupy and Pooley offer of the Simon-Erlich bet captures a sliver of history. Taking a broader view, what humanity faces is the reality of biodiversity loss, climate change, species extinction, ocean acidification, alienation, political polarization, and so on. Yes, progress has been made, but on the way a lot of damage has been done. In a world experiencing accelerating existential crises, faith that people will always be able to innovate and produce themselves out of a problem seems, at a minimum, to violate an essential precautionary principle. Why bet on the future of our children? No matter how innovative we may be, humanity needs to face up to basic laws of thermodynamics: exponential growth on a finite planet represents an impossibility. Even energy provided by the sun, often cited as a presumably limitless source of energy, needs substantial earth-generated resources to be of use.

Growth always creates both opportunities and harm. Today, a suite of indicators (for instance, Legatum, GPI, Social Progress) tell us that GDP-rich countries have reached the threshold beyond which further increases in economic output produce more harm than benefits: rising inequality, species extinction, climate change, etc). Let us offer an analogy: a starving patient, barely surviving on 300 calories a day, has her doctor advise a doubling of calorie intake. On 600 calories, the patient becomes stronger and healthier, but not yet well. The doctor repeats his advice, having seen its benefit: to 1200 calories. And again: to 2400 calories and then to 4,800 and beyond. Our patient now not only faces diminishing marginal returns. Continuing a regimen of exponential growth will kill her.

Beyond Superabundance as a Vision: to a Wellbeing Economy

Tupy and Pooley offer a vision where prices and technology interact to ensure an abundant supply of physical resources: a vision they embrace as “superabundance.” Aside from our concerns raised above: does this really align with a world people want to live in? Surveys of public opinion (see here and here), the outputs of deliberative democracy exercises, and even witnessing how humans cooperate, care for each other, and act out of empathy, suggest it is not.

Superabundance is a market-driven world of hyper-commodification and the monetization of everything. It is a vision in which accumulation is the utmost goal—mirrored, we assume, at the macroeconomic level by higher rates of GDP growth per capita.

Our concerns are as follows:

- First, more GDP does not equate to quality of life for enough people; trickle-down simply does not work

- Second, endless pursuit of exponential GDP growth inevitably harms people and planet; it is market failure run amok

- Third, the narrow pursuit of more, by failing to incorporate the higher ambitions of humanity, represents a grim vision of progress.

As we explore in more depth elsewhere (here , here and here), at some point the goal of more in fact translates into less, and fails to capture what we would consider human thriving—the meaning of life beyond accumulating stuff.

Following the simple logic of mainstream economists, which Tupy and Pooley praise Simon for doing, one might be doubtful of our broader vision. But the uncritical support of continued exponential growth, at least among experts, is rapidly becoming a lonely stance. From behavioral to ecological to feminist or indigenous economists, to historians, sociologists, and climate scientists, growing numbers of experts have concluded that exponential growth is neither feasible nor desirable.

Major institutions are beginning to concede that GDP growth does not give a good account of people’s wellbeing. There are many to cite, from the EU to the World Economic Forum to the World Bank to the former head of the UK Civil Service to a report generated by prominent economists. Given space constraints, this from the OECD, gives a flavor:

it is widely understood that GDP is a measure of economic production, rather than of people’s well-being…GDP does not capture important elements of living standards, such as leisure time, health, social connections or the quality of working environment; it does not reflect inequalities, which are important for the assessment of the well-being of any community of people; and it is blind to the effects that changes in the scale of economic production may impose on the stock of resources that sustain well-being over time, including natural resources.

What sort of economic system and goals would put wellbeing to the fore? A Wellbeing Economy positions the economy in service of human flourishing and true freedom; less precariousness and more dignity; fewer dirty industries and more businesses who put their workers and communities front and center. It is a broad, inclusive agenda that understands that economic systems which operate efficiently and effectively will support human needs and do so in a way that recognizes ecological health and biophysical boundaries, as highlighted by the UK Treasury commissioned Dasgupta Review.

To the extent that we agree on goals such as everyone’s rights to eat, to live a life free of poverty and oppression, and our shared concern for humanity writ large, the work and tools Tupy and Pooley bring will no doubt be necessary in pursuit of a Wellbeing Economy, so long as we can meet on the need to recognize the distinction between means and ends. In those efforts, we welcome their thinking about abundance and human ingenuity. But for those who aspire to a thriving life, accessible to all, markets and prices alone will always remain insufficient.

Lead Essay

Resources Are More Abundant Than Ever, and People Are the Reason

Our research into the relative abundance of resources began when we looked at updating the famous wager between the cornucopian University of Maryland economist Julian Simon (1932–1998) and three neo-Malthusian scholars: the Stanford University biologist Paul Ehrlich; the University of California, Berkeley ecologist John Harte; and the University of California, Berkeley scientist and future director of President Barack Obama’s White House Office of Science and Technology John P. Holdren.[1]

The Ehrlich group bet $200 each on five metals: chrome, copper, nickel, tin, and tungsten. Then they signed a futures contract which stipulated that Simon would sell these same quantities of metal to Ehrlich’s group for the same price in ten years’ time. Since price is a reflection of scarcity, if population increases made these metals scarcer, Simon would pay, but if they became more abundant, and therefore cheaper, Ehrlich would pay. The bet would last from September 29, 1980 to September 29, 1990.

Between 1980 and 1990, the world’s population rose from 4.4 billion to 5.3 billion, or 20.5 percent. Yet the price of the five-metal basket barely moved, rising in nominal terms from $1,000 to $1,003.93, or 0.4 percent. Given that inflation amounted to 57.4 percent, all five metals became cheaper in real terms. In October 1990, Ehrlich mailed Simon a spreadsheet of metal prices and a check for $576.07, which represented a 36 percent decrease in inflation-adjusted prices. Ehrlich’s wife, Anne, signed it.

Ehrlich and his group lost because they thought like biologists. In 1971, for example, Ehrlich and Holdren wrote that as “a population of organisms grows in a finite environment, sooner or later it will encounter a resource limit. This phenomenon, described by ecologists as reaching the ‘carrying capacity’ of the environment, applies to bacteria on a culture dish, to fruit flies in a jar of agar, and to buffalo on a prairie. It must also apply to man on this finite planet.”

Simon won because he thought like an economist. He understood the powers of incentives and the price mechanism to overcome resource shortages. Instead of the quantity of resources, he looked at the prices of resources. He saw resource scarcity as a temporary challenge that can be solved through greater efficiency, increased supply, development of substitutes, and so on.

The relationship between prices and innovation, Simon insisted, is dynamic. Relative scarcity leads to higher prices, higher prices create incentives for innovations, and innovations lead to abundance. Scarcity gets converted to abundance through the price system. The price system functions as long as the economy is based on property rights, the rule of law, and freedom of exchange. In relatively free economies, therefore, resources do not get depleted in the way that Ehrlich feared they would. In fact, resources tend to become more abundant.

Simon’s victory would have been even more impressive had he used time prices (TP). The TP denotes the amount of time that a buyer needs to work in order to earn enough money to be able to buy something. That is the relevant price from the individual’s vantage point. Unlike money prices, which are measured in dollars and cents, TPs are measured in hours and minutes of labor.

The easiest way to calculate TP is to divide the nominal price by the nominal hourly income. If an item costs you $1 and you earn $10 per hour, then that item will cost you 6 minutes of work. If the price of the same item increases to $1.10 and your hourly income increases to $12, then that item will only cost you 5 minutes and 24 seconds of work. The most important thing to remember is that as long as hourly income is increasing faster than the money price, the TP will decrease.

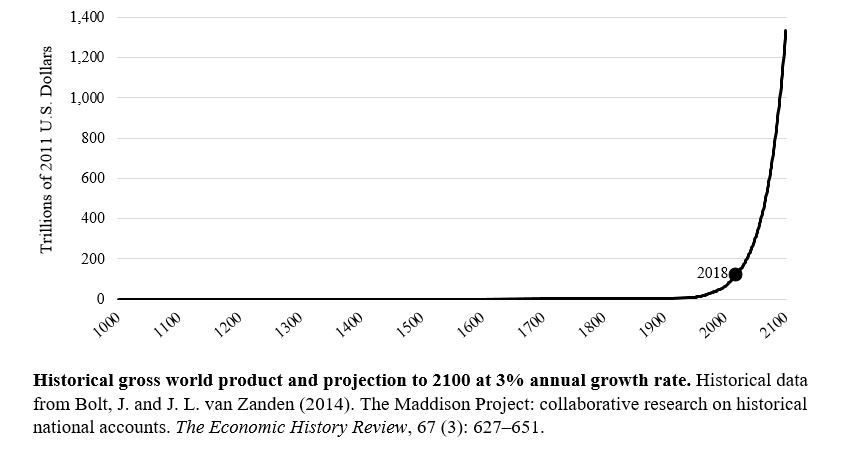

As we already noted, over the course of the Simon-Ehrlich wager, the nominal price of the five-metal basket rose by 0.4 percent. Over the same period, the average global nominal GDP per hour worked increased by about 67 percent. To calculate the TP of the five-metal basket, we divided the nominal prices of the basket by the average global nominal GDP per hour worked. We found that the average TP of the five-metal basket fell by almost 40 percent. Had Simon and Ehrlich used TPs, Ehrlich would have owed Simon $627.57, or 8.93 percent more than he actually paid.

Remember that the bet between Simon and Ehrlich took into account the nominal prices of the five metals on September 29, 1980 and September 29, 1990. However, if we look at the average annual nominal prices of the five metals between 1980 and 1990, the average TP of the five-metal basket declines by 54.8 percent. So, for the same length of work, the average inhabitant of the globe saw his resource abundance increase from 1 basket of the five metals to 2.21 baskets. That amounts to a 121 percent increase in the average personal resource abundance (pRA). The average compound annual growth rate in personal resource abundance (CAGR-pRA) came to 8.27 percent, thus indicating a doubling of the average pRA every 8.7 years.

Did Simon get lucky by picking a propitious decade for his bet with Ehrlich, as some scholars argue he did? We decided to use our methodology to bring the bet up to the present. Between 1980 and 2018, the average TP of the five-metal basket decreased by 57.3 percent. Instead of just one basket, therefore, the same length of work bought 2.34 baskets. That amounts to a 134 percent increase in the average pRA. The average CAGR-pRA came to 2.27 percent, thus indicating a doubling of the average pRA every 31 years.

Finally, we have decided to extend our analysis of the Simon-Ehrlich wager all the way back to 1900. Between 1900 and 2018, the nominal price of the five-metal basket increased by an average of 3,660 percent. We were not able to calculate average global nominal GDP per hour worked for a representative sample of countries going back to 1900, but we do have excellent data on the U.S. blue-collar hourly compensation rate and the U.S. unskilled hourly wage rate going back to the eighteenth century. We used those two as our denominators to calculate TPs.

The average nominal U.S. blue-collar worker hourly compensation rate increased by 22,800 percent. That means that the average TP of the five-metal basket fell by 89.2 percent between 1900 and 2018. Thus, the U.S. blue-collar worker saw his resource abundance increase from one basket of the five metals to 9.26 baskets. The average pRA increased by 826 percent. The average CAGR-pRA rate amounted to 1.91 percent, thus indicating a doubling of the average pRA every 36.7 years.

The average nominal U.S. unskilled worker hourly wage rate increased by 14,100 percent. As such, we found that the average TP of the five-metal basket fell by 82.6 percent between 1900 and 2018. So, the U.S. unskilled worker saw his resource abundance increase from one basket of the five metals in 1900 to 5.75 baskets in 2018. The average pRA increased by 475 percent. The average CAGR-pRA amounted to 1.49 percent, indicating a doubling of the average pRA every 46.7 years.

Table 1: Personal Resource Abundance Analysis of the Simon-Ehrlich Wager

Source: Authors’ calculations.

Note that the above Personal Resource Abundance analysis looked at the abundance of the five metals from the perspective of an individual human being. The question that we tried to answer was, “How much more abundant have resources become for an average inhabitant of the planet or a typical U.S. worker between two points in time?” We believe that this is a key question in resource economics.

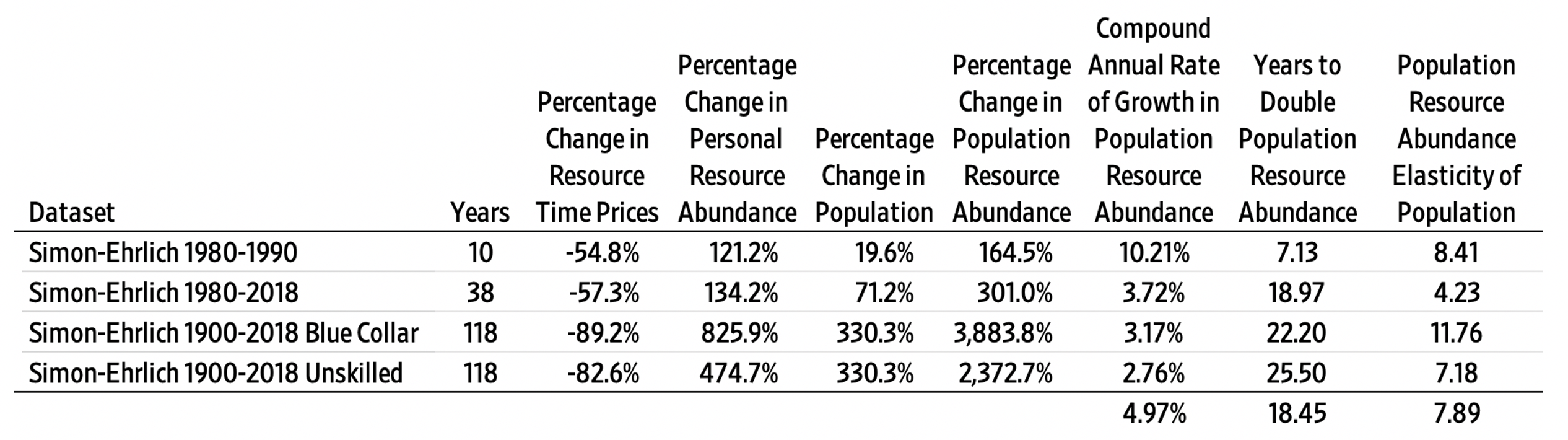

Next, we introduce the Population Resource Abundance analysis, which estimates the rise in total abundance in the world in general and in the United States in particular. It is this Population Resource Abundance analysis that allows us to quantify the relationship between abundance of resources and population growth—a question that’s central to the disagreement between Simon and Ehrlich.

You can think of the difference between the two levels of analysis by using a pizza analogy. Personal Resource Abundance measures the size of a slice of pizza per person. Population Resource Abundance measures the size of the entire pizza pie.

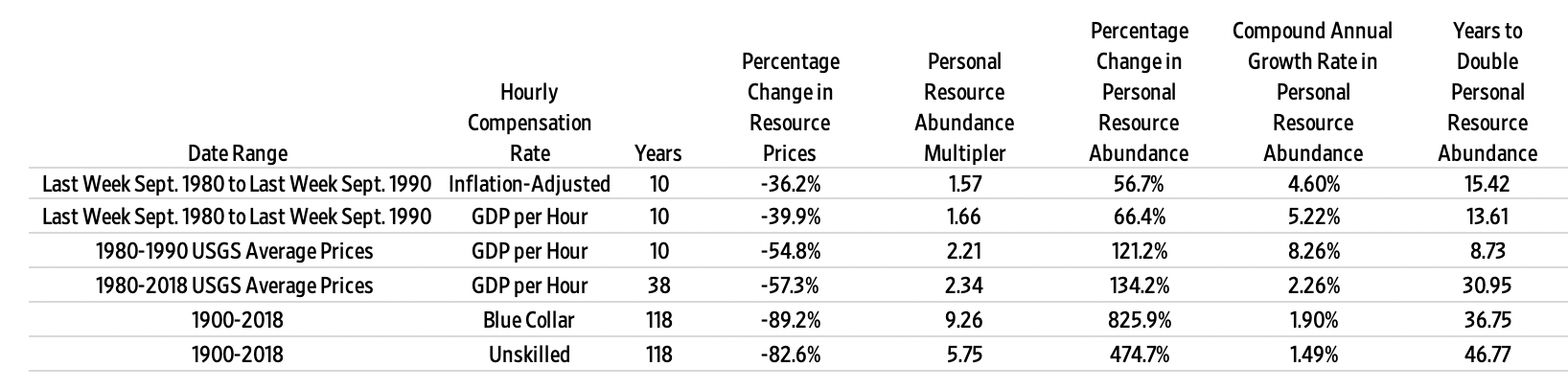

Table 2: Population Resource Abundance Analysis of the Simon-Ehrlich Wager

Source: Authors’ calculations.

As noted, the world’s population rose by 20.5 percent between 1980 and 1990. Yet population resource abundance (PRA) rose from one pie to 2.64, or 164 percent. The compound annual growth rate in population resource abundance (CAGR-PRA) amounted to 10.21 percent, indicating a doubling of PRA every 7.13 years. Furthermore, we found that every one percent increase in population corresponded to an 8.41 percent increase in the PRA of the five metals.

Between 1980 and 2018, the world’s population rose by 71.2 percent. Yet PRA rose from one pie to 4.01, or 301 percent. The CAGR-PRA amounted to 3.72 percent, indicating a doubling of PRA every 18.97 years. Furthermore, we found that every one percent increase in population corresponded to a 4.23 percent increase in the PRA of the five metals.

Between 1900 and 2018, the U.S. population increased by 330.3 percent. Based on blue-collar compensation, the U.S. resource abundance (PRA) rose from one to 39.84, or 3,884 percent. The CAGR-PRA amounted to 3.17 percent, indicating a doubling of PRA every 22.2 years. Furthermore, we found that every one percent increase in the U.S. population corresponded to a 11.76 percent increase in the PRA of the five metals.

Based on the unskilled wage rate, the U.S. resource abundance (PRA) rose from one to 24.73 or 2,373 percent. The CAGR-PRA amounted to 2.76 percent, indicating a doubling of PRA every 25.5 years. Furthermore, we found that every one percent increase in the U.S. population corresponded to a 7.18 percent increase in the PRA of the five metals.

Figure 1

Finally, we found that humanity is experiencing what we term Superabundance—a condition where abundance is increasing at a faster rate than the population is growing. Data suggests that additional human beings tend to benefit, rather than impoverish, the rest of humanity. That vindicates Julian Simon’s observation that

There is no physical or economic reason why human resourcefulness and enterprise cannot forever continue to respond to impending shortages and existing problems with new expedients that, after an adjustment period, leave us better off than before the problem arose.… Adding more people will cause [short‐run] problems, but at the same time there will be more people to solve these problems and leave us with the bonus of lower costs and less scarcity in the long run.… The ultimate resource is people—skilled, spirited, and hopeful people who will exert their wills and imaginations for their own benefit, and so, inevitably, for the benefit of us all.

Note

[1] This essay is based on an upcoming book by Marian L. Tupy and Gale Pooley with the working titleThe Age of Superabundance: How Population Growth and Freedom to Innovate Lead to Human Flourishing on an Infinitely Bountiful Planet.

The Conversation

How Markets Create Value: A Response to Philipsen and Trebeck

I wish to thank Dirk Philipsen and Katherine Trebeck for their response to our lead essay. I share their aspiration for creating an environment where people can flourish. Below, I outline a few thoughts on the importance of markets and innovation.

Economics Is Not Physics

It is a common confusion that economic growth is based on physical things. Among other things, economics is a study of value creation. Economics does not refute the law of thermodynamics or the fact we have a finite number of atoms on the planet. It is the value of things that count, not the quantity of things.

Thomas Sowell noted that “The cavemen had the same natural resources at their disposal as we have today, and the difference between their standard of living and ours is a difference between the knowledge they could bring to bear on those resources and the knowledge used today.”

Knowledge is not subject to the laws of physics. As George Gilder put it, “Wealth is knowledge and growth is learning.”

Markets Enable Innovation and Cooperation

The market is the process for discovering what’s valuable. It is where inventions are tested for their value-creating potential. It is where learning occurs. In order to maximize the learning that can occur in markets, buyers and sellers must be free to come and go, and prices must be free to rise and fall. Centrally planned economies always fail, because people cannot learn what’s valuable and what’s not valuable.

But markets serve another important role in human society. They build trust and cooperation. Goods and services are traded among strangers and across vast distances, guided—to a great degree—by the valuable information produced by the price mechanism and by the reputation of the trading parties. Repeated transactions among trading parties encourage trustworthiness—a moral side-product of capitalism that we do not spend enough time talking about, let alone celebrating.

Precaution and Risk

Embrace of the precautionary principle can actually result in a more dangerous and poorer world. As Martin Peterson, Research Fellow in the Department of History and Philosophy of Science at the University of Cambridge as noted:

There is no doubt that a [new product] might be dangerous and that precautionary measures should be taken to avoid unnecessary risks; however, the precautionary principle makes a much stronger claim about decision-making. It tells us to replace traditional cost–benefit analyses with a more imprecise reasoning that focuses on possible negative effects. The precautionary principle therefore replaces the balancing of risks and benefits with what might best be described as pure pessimism.

We enjoy prosperity today because our parents and grandparents bet on the future by balancing precaution against potential gains.

Global Inequality Is Decreasing

Branko Milanovic, a former lead economist in the World Bank’s research department, is a recognized authority on measures of income inequality. He found that income inequality has declined substantially since 1980. He compared Gini coefficients between countries on a population-weighted basis and calculated that the global Gini coefficient had declined by 26.2 percent, from .61 in 1980 to .45 in 2017.

Innovation Benefits the Poor Most

Since the poor spend much more of their income on basic food commodities, a reduction in the time price of commodities benefits the least fortunate the most. Since 1960 the time price of rice has fallen by 87.2 percent. This means that rice has become 681 percent more abundant. That means that instead of spending eight hours a day working to buy food, people in developing countries can spend less than one hour working to buy food. They now have seven hours a day to improve their lives in other ways such as discovering and creating valuable things and using their new wealth to buy new clothes, better housing, more education, etc.

Production versus Productivity

One of the main differences between centrally planned and market-based economies is that the former focused on producing more, whereas the latter focus on producing more with less. A capitalist asks, “How can I reduce inputs, in order to increase the value of what I create?” A socialist in contrast, asks, “What do I have to do to meet my production quota?” The former searches for ways to save resources. The latter does not have the information or the incentive to care. That’s why the environmental record of centrally planned economies was so much worse than the environmental record of market-based economies.

We have already noted Andrew McAfee’s revolutionary findings concerning the absolute decline in the use of resources in advanced economies. He has put up $100,000 on even-money bets that by 2029 the United States will consume in total fewer metals, fewer industrial materials, less timber, less paper, less fertilizer, less water for agriculture, less energy, and use less cropland, and have lower greenhouse gas emissions. Details about these bets are available at the Long Bets website. Will the skeptics like Paul Ehrlich bet against him?

The World Is Indeed Improving: A Response to Philipsen and Trebeck

I wish to thank Dr. Katherine Trebeck and Dr. Dirk Philipsen for their response to our lead essay. It is a pleasure to discuss important ideas with scholars who are searching for the truth and human betterment. Trebeck and Philipsen question “the human ability to invent itself out of the basic laws of physics” and call for “A Wellbeing Economy [that] positions the economy in service of human flourishing and true freedom; less precariousness and more dignity; fewer dirty industries and more businesses who put their workers and communities front and center.”

I agree that humanity still faces many problems, but I ask, along with the British historian Thomas Babington Macaulay, “On what principle is it that with nothing but improvement behind us, we are to expect nothing but deterioration before us.”[1] Below, I outline a number of ways in which the world has become a better place over the last few decades and propose that many people are already living in a Wellbeing Economy—one that was, in large part, created by the market forces that Trebeck and Philipsen bemoan.

Let’s start with income, for richer societies can afford more food, better healthcare, higher levels of education, and so on. Between 1950 and 2019, the average income per person in the United States rose from $15,001 to $63,233, or 322 percent. In the United Kingdom, it rose from $12,008 to $44,960, or 274 percent. Between 1952 and 2019, the population-weighted average global income per person rose from $4,063 to $18,841, or 364 percent (all figures are in 2018 U.S. dollars).[2]

Increased prosperity was not confined to developed nations. Some of the world’s poorest countries benefited handsomely from income growth over the last few decades. The growth in Chinese incomes, from $238 in 1952 to $19,800 in 2019, amounts to a staggering 8,219 percent. India saw its average income rise from $930 to $8,148, or 776 percent. Even sub-Saharan Africa, the world’s poorest region, saw its income per person rise from $2,222 to $3,866, or 74 percent (all figures are again in 2018 U.S. dollars).[3]

Except for a handful of war-torn African countries, such as the Democratic Republic of the Congo, and failing socialist countries, such as Venezuela, real incomes rose throughout the world over the last half-century—often substantially.

Now, consider the population-weighted average global life expectancy, which rose from 52.6 years in 1960 to 72.4 years in 2017, or 37.6 percent. In the United States, it rose from 69.8 years to 78.5 years, or 13 percent. In the United Kingdom, it rose from 71.1 years to 81.2 years, or 14 percent.

Once again, the world’s poorest nations experienced some of the greatest life expectancy gains: China, from 43.7 years to 76.4 years, or 75 percent; India, from 41.2 years to 68.8 years, or 67 percent; and sub-Saharan Africa, from 40.4 years to 60.9 years or 51 percent. There is not a single country in the world where life expectancy was lower in 2017 than it was in 1960.[4]

The reasons for increasing life spans include the dramatic decline in infant mortality and improved nutrition. Between 1960 and 2018, the infant mortality rate per 1,000 live births fell from 25.9 to 5.6 in the United States, from 22.9 to 3.6 in the United Kingdom, and from 161 to 30 in India. That’s a reduction of 78 percent, 84 percent, and 81 percent, respectively. Between 1990 and 2018, the population-weighted average global infant mortality rate fell from 64.7 to 28.9, or 55 percent. In sub-Saharan Africa, it fell from 107 to 53, or 51 percent. In China, it fell from 83.7 in 1969 to 7.4 in 2018, or 91 percent.[5]

The population-weighted average global food supply per person per day rose from 2,115 calories in 1961 to 2,917 calories in 2017, or 38 percent. Over the same period, it rose from 2,880 calories to 3,766 calories, or 31 percent in the United States; from 3,231 calories to 3,428 calories, or 6 percent in the United Kingdom; from 1,415 calories to 3,197 calories, or 126 percent in China; and from 2,010 calories to 2,517 calories, or 25 percent in India.[6]

To put these figures in perspective, the U.S. Department of Agriculture recommends that moderately active adult men consume between 2,400 and 2,600 calories a day, and moderately active adult women consume 2,000 calories a day.[7]

In sub-Saharan Africa, a region that once seemed destined for hunger, food supply rose from 2,004 calories in 1961 to 2,447 calories in 2017. That’s a 22 percent increase. Put differently, the world’s poorest region now enjoys access to food that is roughly equivalent to that of the Portuguese in the early 1960s.[8]

In fact, scientists from the African Population and Health Research Center in Kenya estimated that in four out of 24 African countries surveyed in 2017, obesity prevalence among urban women exceeded 20 percent. It ranged between 10 percent and 19 percent in the other 20 countries.[9] Today, obesity tends to be a bigger problem than starvation in many parts of the world, and famines have disappeared outside war zones, such as Yemen in 2020.

Speaking of violence, the global homicide rate, according to the Institute of Health Metrics and Evaluation in Seattle, has dropped from 6.4 per 100,000 in 1990 to 5.3 per 100,000 in 2016. That’s a reduction of 17 percent over a remarkably short period of 26 years.[10]

Similarly, researchers at the Peace Research Institute in Oslo have documented a steep decline in the rate at which soldiers and civilians were killed in combat in the post–World War II era. The rate of battle deaths per 100,000 people reached a peak of 23 in 1953.[11] By 2016, it had fallen to just over 1. That’s a decline of about 95 percent.[12]

Genocides, noted the Harvard University psychologist Steven Pinker in his 2018 book Enlightenment Now: The Case for Reason, Science, Humanism and Progress, tend to go hand in hand with wars. In the late 1930s, for example, the global genocide death rate among civilians hovered around 100 per 100,000 per year. During World War II, it reached a peak of 350. It then gradually declined. Since 2005, it has stood at zero.[13]

Also, more people go to school and are able to read. The population-weighted gross primary school enrollment rate in the world stood at 89 percent in 1970. By 2018, it stood at over 100 percent (because some students will be over-aged, under-aged, or grade repeaters, the gross rate can exceed 100 percent).[14] The population-weighted gross secondary school enrollment rate rose from 40 percent to 76 percent over the same period.[15] Finally, the population-weighted gross tertiary school enrollment rate rose from 9.7 percent to 38 percent.[16]

The population-weighted global literacy rate among men aged 15 and older came to 74 percent in 1975. That number rose to 90 percent in 2018.[17] The literacy rate among women aged 15 and older rose from 56 percent in 1976 to 83 percent in 2018.[18] In 2018, 90 percent of women between the ages of 15 and 24 were literate.[19] That number was almost 93 percent among men of the same age.[20] The age-old literacy gap between the sexes has all but disappeared.

Rates of extreme poverty have plummeted, with the share of people living on less than US$1.90 per day declining from 42 percent in 1981 to less than 10 percent in 2015. In China, it fell from 66 percent in 1990 to an astonishingly low 0.5 percent in 2016. In India, it fell from 62 percent in 1977 to 21 percent in 2011.[21]

Today, extreme poverty is no longer a global problem, but an African problem. Yet even the world’s poorest region saw extreme poverty decline from 55 percent in 1990 to 42 percent in 2015.[22] That reduction may seem underwhelming until we realize that the population of sub-Saharan Africa doubled from 512 million to 1.006 billion over the same period.

Speaking of Africa, Mauritania became the last country in the world to outlaw chattel slavery in 1981 and to criminalize the practice of enslavement in 2007.[23] A scourge of humanity for thousands of years, chattel slavery is legal no more.

Or consider political freedom. The Center for Systemic Peace in Virginia evaluates the characteristics of a political regime in each country on a 20-point scale from -10, which denotes a tyranny like North Korea, to 10, which denotes a politically free society like Norway. “As of the end of 2017, 96 out of 167 countries with populations of at least 500,000 (57 percent) were democracies of some kind, and only 21 (13 percent) were autocracies … [Some] 28 [percent of countries] exhibited elements of both democracy and autocracy. Broadly speaking, the share of democracies among the world’s governments has been on an upward trend since the mid-1970s, and now sits just shy of its post-World War II record (58 percent in 2016).”[24]

Other positive trends that I discussed in my recent book, Ten Global Trends Every Smart Person Should Know: And many others you will find interesting, include the rise in global happiness, the decline in global income inequality, the falling share of the world’s population living in slums, the political and economic empowerment of women, the uneven but pronounced rise in IQ scores, the decriminalization of same-sex relationships, the continued rise in vaccinations against contagious diseases, the decline of contagious diseases (such as HIV/AIDS, malaria and tuberculosis), falling cancer death rates, the decline in the use of capital punishment, falling rates of military spending and conscription, the shrinkage of nuclear arsenals, the decline in working hours thus leaving more time for leisure, falling rates of child labor and workplace accidents, increasing access to electricity, improving access to sanitation and clean drinking water, and internet-driven access to information.[25]

In fact, it is much easier to compile a list of global trends that are worsening than a list of global trends that are improving, for the former is much shorter than the latter.

The most obvious worry to a diverse group of people—ranging from the apocalypticists at the one end to merely concerned citizens at the other end—is the state of the planet’s environment. Yet it is worth noting that even within the environmental sphere, there is plenty of positive news. Between 1982 and 2016, for example, the global tree canopy cover increased by an area larger than Alaska and Montana combined.[26] As Reason magazine science correspondent Ronald Bailey put it, “Expanding woodlands suggests that humanity has begun the process of withdrawing from the natural world, which, in turn, will provide greater scope for other species to rebound and thrive.”[27]

According to the same author, “The chance of a person dying in a natural catastrophe—earthquake, flood, drought, storm, wildfire, landslide or epidemic—has declined by nearly 99 percent since the 1920s and 1930s … Buildings are better constructed to survive earthquakes; weather satellites and sophisticated computer models provide early storm warnings that give folks time to prepare and evacuate; and broad disease surveillance enables swift medical interventions to halt developing epidemics.”[28]

The Rockefeller University environmentalist Jesse H. Ausubel estimated in 2014 that due to the continued improvements in the efficiency of farming practices, including rising crop yields, the world will see “a net reduction in use of arable land (i.e., land used for farming) in about 50 years totaling 10 times the area of Iowa, and shrinking global cropland to the level of 1960.”[29]

In 2017, the World Database on Protected Areas reported that 15 percent of the planet’s land surface was covered by protected areas. That’s an area more than three times the size of the United States. Marine protected areas covered nearly 7 percent of the world’s oceans. That’s an area more than twice the size of South America.[30]

Part of the reason for rising marine conservancy is fish farming, which enables humans to consume increasing quantities of fish without decimating aquatic wildlife. “In 1950,” noted Bailey, “aquaculture produced less than a million metric tons of fish. In 2016, aquaculturists raised more than 80 million metric tons of fish—51 million tons on inland fish farms and 29 million tons at sea.”[31]

We are also getting better at producing goods and services in ways that are less harmful to the environment. Consider sulfur dioxide (SO2), a toxic gas that is a by-product of copper extraction and the burning of fossil fuels. Global sulfur dioxide emissions declined from a peak of 152 million tons in 1980 to 97 million tons in 2010—a reduction of 36 percent over a comparatively short period of 30 years.[32] The volume of SO₂ emissions in the United States decreased from about 31 million tons in 1970 to about 2 million tons in 2019—a reduction of 94 percent.[33]

Speaking of burning of fossil fuels, the average global CO2 emissions per dollar of output declined by 41 percent between 1960 and 2014 (i.e., from 0.84 kilograms to 0.5 kilograms).[34] Those are the latest figures that we had access to. We suspect that the recent switch from burning coal to burning natural gas in many countries will help to reduce CO2 emissions per dollar of output even further because natural gas emits between 50 and 60 percent less CO2 when combusted in a new, efficient natural gas power plant compared with emissions from a typical new coal plant.[35] And that’s not accounting for the rise in non-fossil fuel sources of power, such as wind and solar.

Moreover, note the long-term relationship between the intensity of CO2 emissions and economic development. “On average,” wrote the University of Oxford economist Max Roser, “we see low carbon intensities at low incomes; carbon intensity rises as countries transition from low-to-middle incomes, especially in rapidly growing industrial economies; and as countries move towards higher incomes, carbon intensity falls again.”[36]

That’s precisely what we are seeing in the data. To be sure, global CO2 emissions are still rising—they reached 36.44 billion tons in 2019—but looking at individual countries provides a more positive picture. For example, the U.S. CO2 emissions declined from a high of 6.13 billion tons in 2007 to 5.28 billion tons in 2019—a 14 percent reduction in 12 years. In the European Union, they fell from a peak of 4.1 billion tons in 1979 to 2.92 billion tons in 2019.[37]

We are also getting better at saving fresh water, which is used widely in agriculture and well as in industrial production. The World Bank estimates that the United States increased its water productivity, or inflation-adjusted dollars of GDP per cubic meter of fresh water withdrawn, from $13 in 1980 to $36 in 2010; China from $0.8 in 1980 to $15 in 2015; Japan from $34 in 1980 to $67 in 2009; Germany from $58 in 1991 to $104 in 2010 and the United Kingdom from $91 in 1980 to $314 in 2012.[38]

Finally, consider the revolutionary findings of the Massachusetts Institute of Technology scientist Andrew McAfee in his 2019 book More from Less: The Surprising Story of How We Learned to Prosper Using Fewer Resources―and What Happens Next. For a long time, economists knew that the profit motive compels companies to decrease the use of natural resources per dollar of output. When aluminum cans were introduced in 1959, for example, they weighed 85 grams. By 2011, they weighed 13 grams.[39] Why use more inputs for the same output if you don’t have to?

As McAfee discovered by looking at the U.S. consumption of 72 resources (from aluminum to zinc), the absolute annual use of 66 resources peaked prior to 2019.[40] Even energy use decreased between 2008 and 2017, even though the U.S. economy expanded by 15 percent over the same period. The U.S. economy, in other words, has reached such a level of efficiency and sophistication that it is possible for it to produce an ever-increasing amount of goods and services, while, at the same time, using ever fewer resources. There is every reason to expect that, as other economies become similarly advanced, they too will reduce their absolute consumption of resources.

The data above will not come as a total surprise to readers interested in the welfare of our species. Over the last decade alone, a number of highly regarded authors have turned their considerable intellects toward exploring the state of humanity. They include the British writer Matt Ridley in his 2010 book, The Rational Optimist; the Swedish scholar Johan Norberg in his 2017 book Progress: Ten Reasons to Look Forward to the Future; Hans Rosling and Anna Rosling Rönnlund in their 2018 book Factfulness: Ten Reasons We’re Wrong About the World—and Why Things Are Better Than You Think; the Nobel Prize winning economist Angus Deaton in his 2013 book The Great Escape: Health, Wealth, and the Origins of Inequality; the American writer Gregg Easterbrook in his 2018 book It’s Better Than It Looks: Reasons for Optimism in an Age of Fear; Ronald Bailey in his 2015 book The End of Doom: Environmental Renewal in the Twenty-first Century; Bailey and Tupy in their 2020 book Ten Global Trends Every Smart Person Should Know: And Many Others You Will Find Interesting; and last but not least Harvard University psychologist Steven Pinker in his 2011 book The Better Angels of Our Nature: Why Violence Has Declined and his 2018 book Enlightenment Now: The Case for Reason, Science, Humanism, and Progress. All of them found considerable evidence for human progress.

Given how much humanity has accomplished in recent memory, we should be very careful about abandoning the economic and political mechanisms that have enabled so much progress to emerge in the first place.

Notes

[1] Thomas Babington Macaulay and Baron Macaulay, Essays, Critical and Miscellaneous (Boston: Philips, Sampson, and Company, 1859), 115.

[2] “Total Economy Database,” Conference Board (online dataset: “TED 1”), accessed March 27, 2020, https://www.conference-board.org/data/economydatabase/index.cfm?id=27762.

[3] “Total Economy Database,” Conference Board (online dataset: “TED 1”), accessed March 27, 2020, https://www.conference-board.org/data/economydatabase/index.cfm?id=27762.

[4] “Life expectancy at birth, total (years),” The World bank (online dataset), accessed March 27, 2020, https://data.worldbank.org/indicator/SP.DYN.LE00.IN.

[5] “Mortality rate, infant (per 1,000 live births),” The World Bank (online dataset), accessed March 27, 2020, https://data.worldbank.org/indicator/SP.DYN.IMRT.IN.

[6] “Food Supply, Per Person, Per Day, Calories,” Human Progress (online dataset), accessed September 12, 2019, https://humanprogress.org/dwline?p=163&r0=82&c0=2&c1=17&c2=6&c3=4&r1=13… =2013&high=1®=3®1=0.

[7] “Health Facts,” U.S. Department of Health and Human Services, accessed September 12, 2019, https://health.gov/dietaryguidelines/dga2005/toolkit/healthfacts/nutrit….

[8] “Food Supply, Per Person, Per Day, Calories,” Human Progress (online dataset), accessed September 12, 2019, https://humanprogress.org/dwline?p=163&r0=82&c0=2&c1=17&c2=6&c3=4&r1=13… =2013&high=1®=3®1=0.

[9] Dickson Abanimi Amugsi, et al., “Prevalence and Time Trends in Overweight and Obesity Among Urban Women: an Analysis of Demographic and Health Surveys Data from 24 African Countries,” BMJ Open 7, no. 10 (October 2017): https://doi.org/10.1136/bmjopen-2017-017344.

[10] Ronald Bailey and Marian L. Tupy, Ten Global Trends Every Smart Person Should Know: And Many Others you Will Find Interesting (Washington D.C.: Cato Institute, 2020), 81.

[11] Ronald Bailey, “Impending Defeat for the Four Horsemen of the Apocalypse,” Reason, August 3, 2019, https://reason.com/2019/08/03/impending-defeat-for-the-four-horsemen-of….

[12] Max Roser, “War and Peace,” Our World In Data, accessed September 12, 2019, https://ourworldindata.org/war-and-peace.

[13] Steven Pinker, Enlightenment Now: The Case for Reason, Science, Humanism and Progress (New York: Viking Press, 2018), 161.

[14] “School enrollment, primary (% net),” The World Bank (online dataset), accessed March 27, 2020, https://data.worldbank.org/indicator/SE.PRM.NENR.

[15] “School enrollment, secondary (% gross),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SE.SEC.ENRR.

[16] “School enrollment, tertiary (% gross),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SE.TER.ENRR.

[17] “Literacy rate, adult male (% of males ages 15 and above),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SE.ADT.LITR.MA.ZS.

[18] “Literacy rate, adult female (% of females ages 15 and above),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SE.ADT.LITR.FE.ZS.

[19] “Literacy rate, youth female (% of females ages 15-24),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SE.ADT.1524.LT.FE.ZS.

[20] “Literacy rate, youth male (% of males ages 15-24),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SE.ADT.1524.LT.MA.ZS.

[21] “Poverty headcount ratio at $1.90 a day (2011 PPP) (% of population),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SI.POV.DDAY.

[22] “Poverty headcount ratio at $1.90 a day (2011 PPP) (% of population),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/SI.POV.DDAY.

[23] John D. Sutter, “Slavery’s Last Stronghold,” CNN, accessed September 12, 2019, http://www.cnn.com /interactive/2012/03/world/mauritania.slaverys.last.stronghold/index.html.

[24] Drew Desilver, “Despite global concerns about democracy, more than half of countries are democratic,” Pew Research Center, May 14, 2019 https://www.pewresearch.org/fact-tank/2019/05/14/more-than-half -of-countries-are-democratic/.

[25] Ronald Bailey and Marian L. Tupy, Ten Global Trends Every Smart Person Should Know: And Many Others you Will Find Interesting (Washington D.C.: Cato Institute, 2020).

[26] Xiao-Peng Song, et al., “Global Land Change from 1982 to 2016,” Nature 560, no. 1 (August 2018): 639, https://www.nature.com/articles/s41586-018-0411-9.

[27] Ronald Bailey, “Global Tree Cover has Expanded More than 7 Percent Since 1982,” Reason,September 4, 2018, https://reason.com/2018/09/04/global-tree-cover-has-expanded-more-than/.

[28] Ronald Bailey and Marian L. Tupy, Ten Global Trends Every Smart Person Should Know: And Many Others You Will Find Interesting (Washington D.C.: Cato Institute, 2020), 25.

[29] Jesse H. Ausubel, “Peak Farmland and Potatoes,” Plenary address, 2014 Potato Business Summit of the United Potato Growers of America, San Antonio, January 8, 2014, https://phe.rockefeller.edu/docs /Peak%20Farmland%20and%20Potatoes.pdf.

[30] UNEP-WCMW and IUCN, “Protected Planet Report 2016: How Protected Areas Contribute to Achieving Global Targets for Biodiversity,” Cambridge, England and Gland, Switzerland, (2016): https://www.iucn.org/theme/protected-areas/publications/protected-plane….

[31] Ronald Bailey and Marian L. Tupy, Ten Global Trends Every Smart Person Should Know: And Many Others you Will Find Interesting (Washington D.C.: Cato Institute, 2020), 133.

[32] Jan Luiten van Zanden, How Was Life? Global Well-being since 1820 (Paris: OECD Publishing, 2014), https://doi.org/10.1787/9789264214262-en; Z Klimont, S J Smith and J Cofala, “The last decade of global anthropogenic sulfur dioxide: 2000–2011 emissions,” Environmental Research Letters 8, no. 1 (January 9, 2013): https://doi.org/10.1088/1748-9326/8/1/014003.

[33] “Volume of sulfur dioxide emissions in the U.S. from 1970 to 2019,” Statista (online dataset), April 2020, https://www.statista.com/statistics/501303/volume-of-sulfur-dioxide-emi….

[34] “CO2 emissions (kg per 2010 US$ of GDP),” The World Bank (online dataset), accessed March 30, 2020, https://data.worldbank.org/indicator/EN.ATM.CO2E.KD.GD.

[35] “Environmental Impacts of Natural Gas,” Union of Concerned Scientists, June 19, 2014, https://www.ucsusa.org/resources/environmental-impacts-natural-gas.

[36] Hannah Ritchie and Max Roser, “CO₂ and Greenhouse Gas Emissions,” Our World in Data, accessed March 30, 2020, https://ourworldindata.org/co2-and-other-greenhouse-gas-emissions.

[37] Hannah Ritchie and Max Roser, “CO2 emissions,” Our World in Data, accessed February 3, 2021, https://ourworldindata.org/co2-emissions.

[38] “Water productivity, total (constant 2010 US$ GDP per Cubic Meter of Total Freshwater Withdrawal),” The World Bank (online dataset), accessed September 12, 2019, https://data.worldbank.org/indicator /ER.GDP.FWTL.M3.KD?locations=US&name_desc=true.

[39] Andrew McAfee, More from Less: The Surprising Story of How We Learned to Prosper Using Fewer Resources―and What Happens Next (New York: Charles Scribner’s Sons, 2019), 101.

[40] “In sustainability parlance,” wrote Pierre Desrochers in a recent paper, “relative decoupling refers to environmental impacts growing at a slower rate than population or consumption. This is achieved through productivity gains, from increased agricultural yields to lower energy inputs per unit of output. Absolute decoupling describes declining overall impacts, independent of population and consumption trends. It is most commonly achieved through resource substitution such as the reduction in the number of work horses and mules brought about by the advent of the truck, tractor and the automobile; the reduction in greenhouse gas emissions that resulted from the substitution of coal by natural gas in electricity generation; or the replacement of paper by electronic devices.” See Pierre Desrochers, “The Paradoxical Malthusian. A Promethean Perspective on Vaclav Smil’s Growth: From Microorganisms to Megacities (MIT Press, 2019) and Energy and Civilization: A History (MIT Press, 2017),” Energies 13, no. 20: 5306, https://doi.org/10.3390/en13205306.

How Dematerialization Is Changing the World: A Response to Giorgos Kallis

We wish to thank Dr. Giorgios Kallis for his wide-ranging response to our lead essay and for his collegiate tone. Kallis writes that “The problem now is not resource scarcity, but damage to the environment (e.g., biodiversity).” He notes that “Resource use grows hand in hand with GDP, even in service economies like the US or the UK where economists expected reductions,” and he advocates in favor of “degrowth.” Finally, Kallis believes that “satisfactory levels of wellbeing can be achieved at a fraction of the highest national incomes.”

The focus on environmental damage as a by-product of population growth, economic growth, and growth in consumption has a long pedigree. In 1982, for example, a group of ecological economists met in Stockholm and published a manifesto warning of natural limits on human activity. “Ecological economists distinguished themselves from neo-Malthusian catastrophists by switching the emphasis from resources to systems,” wrote one historian of this period. Their “concern was no longer centered on running out of food, minerals, or energy. Instead, ecological economists drew attention to what they identified as ecological thresholds. The problem lay in overloading systems and causing them to collapse.”[1]

Four decades later, scientific debate about “ecological thresholds” remains unsettled—even when it comes to the basic question of measurement.[2] In August 2020, for example, a monthly peer-reviewed scientific journal called Nature Ecology & Evolution published a study based on 36 meta-analyses of more than 4,600 individual studies covering the last 45 years of research on ecological thresholds. Nine German, French, Irish and Finnish ecologists found that

threshold transgressions were rarely detectable, either within or across meta-analyses. Instead, ecological responses were characterized mostly by progressively increasing magnitude and variance when pressure increased. Sensitivity analyses with modelled data revealed that minor variances in the response are sufficient to preclude the detection of thresholds from data, even if they are present. The simulations reinforced our contention that global change biology needs to abandon the general expectation that system properties allow defining thresholds as a way to manage nature under global change. Rather, highly variable responses, even under weak pressures, suggest that “safe-operating spaces” are unlikely to be quantifiable.[3]

Surely, such uncertainty does not warrant a dramatic departure from pro-growth policies. Let us make four additional points. First, as Ted Nordhaus from the Breakthrough Institute in California observed in 2019, pessimists assume that humans will continue to reproduce with abandon. In reality, data show that as an economy becomes more developed, birth rates begin to fall. The massive population growth in recent decades is due to rising life expectancy, not rising fertility.[4] The birth rates of the United States, Europe, Japan, China, and large parts of Latin America have actually fallen below the replacement level of 2.1 children per woman for some time. That means that their populations are actually starting to shrink. It’s likely that the rest of the world will follow that trend. What does that mean?

According to Ron Bailey, “World population will likely peak at 9.8 billion people at around 2080 and fall to 9.5 billion by 2100 in the medium fertility scenario calculated by demographer Wolfgang Lutz and his colleagues at the International Institute of Applied Systems Analysis. Alternatively, assuming rapid economic growth, technological advancement, and rising levels of educational attainment for both sexes—all factors that tend to lower fertility—Lutz projects that world population will more likely peak at around 8.9 billion by 2060 and decline to 7.8 billion by the end of the twenty-first century.”[5]

Considering that there were 7.8 billion humans on the planet in 2020, it is possible that the world’s population will be roughly the same size 80 years from now. If Lutz’s latter estimates are correct, then the world may actually end up facing an underpopulation rather than an overpopulation problem. That’s because, in the absence of a huge breakthrough in artificial intelligence, human beings remain the sole producers of ideas, inventions, and innovations that drive technological, scientific, and medical progress.

Second, pessimists, who recognize that the human population may actually shrink in the future, worry that free enterprise will continue to drive human consumption of resources to higher and higher levels.[6] Again, the data do not agree. In our response to Katherine Trebeck and Dirk Philipsen, we already mentioned McAfee’s 2019 book, More from Less: The Surprising Story of How We Learned to Prosper Using Fewer Resources―and What Happens Next. Sophisticated economies, McAfee found, are currently producing ever more goods and services, while at the same time using ever fewer resources. That is a result of a sustained transition in advanced countries from industry to less resource-intensive economic activities that deal with services and information.

To that process we may also add dematerialization, which refers to declining consumption of material and energy per unit of gross domestic product (GDP). According to Jesse Ausubel from Rockefeller University and Paul E. Waggoner from the Connecticut Agricultural Experiment Station, “If consumers dematerialize their intensity of use of goods and technicians produce the goods with a lower intensity of impact, people can grow in numbers and affluence without a proportionally greater environmental impact.”[7]

Why would people do that? Dematerialization replaces atoms with knowledge and makes economic sense to producers, since spending less on inputs can swell profit margins and make outputs cheaper and therefore more competitive.[8] It makes sense to consumers as well. Consider, for example, the growing use of smartphones. The product combines functions that previously required a myriad of separate devices, including a telephone, camera, radio, television set, alarm clock, newspaper, photo album, voice recorder, maps, compass, and more.

Replacement of many devices with one produces substantial efficiency gains. How substantial? In 2018, a team of 21 researchers led by Professor Arnulf Grubler from the International Institute for Applied Systems Analysis in Austria estimated the “savings from device convergence on smartphones … for materials use (device weight) and for its associated embodied energy use.” They found that smartphones can reduce material use by a factor of 300. They can reduce power use by a factor of 100 and standby energy use by a factor of 30.[9] That means that we use 99.67 percent less material, 99 percent less power, and 97 percent less standby energy.

To summarize, pessimists worry that future growth will mirror that seen during the Industrial Revolution: bigger and deeper mines, bigger and more polluting steel mills, and so on. But economic growth does not have to come from bigness. On the contrary, it can—and does—come from “smartness” with things like miniaturization, as in the computing industry, which saw the replacement of massive mainframe computers with smaller and much more efficient personal computers. To quote the economic historian Joel Mokyr,

The main logical issue here is that economic growth can be resource saving as much as resource-using, and that the very negative effects that congestion and pollution engender will set into motion searches for techniques that will abate them. Such responses may be more effective in democratic than in autocratic regimes because concerned public opinion can map better into public policy, but in the end the need for humans to breathe clean air is about as universal a value as one can find. Investment in soil reclamation, desalination, recycling, and renewable energy count just as much as economic growth as economic activities that use up resources. Whether or not wise policies will help steer technological progress in that direction, the basic notion that per capita income growth has to stop because the planet is finite is palpable nonsense.[10]

Third, pessimists assume that humanity will sit idly by and allow environmental problems to overwhelm our planet. That is highly improbable given our species’ track record of tackling past challenges. According to Nordhaus, it took six times as much land to feed a single person in the Neolithic period as it does now. If we were still harvesting einkorn with sticks and stones, we would certainly be above our carrying capacity. Instead, we’ve improved our agricultural efficiency so much that less than 2 percent of the U.S population actually has to farm at all.[11]

As Ausubel and his colleagues noted in their 2013 article “Peak Farmland and the Prospect for Land Sparing,” if the productivity of the world’s farmers increases to U.S. levels, humanity will be able to restore at least 146 million hectares of cropland land to nature. This is an area two and a half times that of France or the size of ten Iowas.[12] As Bailey observed, “the UN Food and Agriculture Organization reports that land devoted to agriculture (including pastures) peaked in 2000 at 4.915 billion hectares (12.15 billion acres) and had fallen to 4.828 billion hectares (11.93 billion acres) by 2017. This human withdrawal from the landscape is the likely prelude to a vast ecological restoration over the course of this [21st] century.”[13]

In fact, as we write, many of the problems identified by the pessimists are being addressed or are on the cusp of being addressed. The forest coverage is growing in rich countries, species are being protected at record levels throughout the world, freshwater reserves are being replenished through desalination in the Middle East, soil erosion is being reduced through precision agriculture in Israel, and CO2 emissions have fallen in nuclear-friendly France and Sweden. In the future, genetically modified crops could lead to a decline in the use of nitrogen and phosphorus, and wild fish stocks could bounce back through greater use of aquaculture, which is rapidly expanding in China. What’s needed to address current and future problems is freedom and brainpower.

Finally, Kallis is right to note that “de-growth” cannot be expected from poor countries “that need to industrialize and produce necessities.” Yet that is exactly where the greatest population growth and environmental damage occurs and will be occurring for decades to come. With their shrinking populations and environmentally friendly policies, rich countries have greatly reduced their impact on the planet, and further measures—unless they are exceedingly expensive in terms of money and reduced living standards—can only make a marginal difference to the overall environmental trajectory.

Kallis seems to be aware of that when he argues that “satisfactory levels of wellbeing can be achieved at a fraction of the highest national incomes.” Unlike Kallis, we are unconvinced that such measures (even if desirable, which we don’t believe they are) can be sustained within the democratic context. Opinion polls show that support for pro-green policies in rich countries falls off in proportion to the expected reduction in the standard of living. Gilet jaunes, anyone?

Notes

[1] Mark Sagoff, “The Rise and Fall of Ecological Economics: A Cautionary Tale,” The Breakthrough, January 13, 2012, https://thebreakthrough.org/journal/issue-2/the-rise-and-fall-of-ecolog….

[2] A threshold corresponds to a level of environmental pressure that creates a discontinuity in the ecosystem response to this pressure. Thresholds and tipping points pervade environmental policy documents as they allow definition of levels of pressure below which ecosystem responses remain within “safe ecological limits” and above which response magnitudes and their variances increase disproportionately.

[3] Helmut Hillebrand et al., “Thresholds for ecological responses to global change do not emerge from empirical data,” Nature Ecology & Evolution 4, no. 1502-1509 (August 17, 2020): https://doi.org/10.1038/s41559-020-1256-9.

[4] Ted Nordhaus and Sam Haselby, “The Earth’s carrying capacity for human life is not fixed,” Aeon, July 5, 2018, https://aeon.co/ideas/the-earths-carrying-capacity-for-human-life-is-no….

[5] Ronald Bailey and Marian L. Tupy, Ten Global Trends Every Smart Person Should Know: And Many Others you Will Find Interesting (Washington D.C.: Cato Institute, 2020), 13.

[6] Canadian researchers Pierre Desrochers and Joanna Szurmak note that “the idea that effective attempts to address climate change must involve population control – and that population control in itself is insufficient if overall mass consumption keeps increasing – has become a new form of what author Greg Easterbrook calls ‘collapse anxiety,’ which he defined as a ‘widespread feeling that the prosperity [of the developed world] cannot really be enjoyed because the Western lifestyle may crash owing to economic breakdown, environmental damage, resource exhaustion…or some other imposed calamity.’” Pierre Desrochers and Joanna Szurmak, Population Bombed: Exploding the link Between Overpopulation and Climate Change (London: Global Warming Policy Foundation, 2018), 2.

[7] Jesse H. Ausubel and Paul E. Waggoner, “Dematerialization: Variety, caution, and persistence,” PNAS 105, no. 35 (September 2, 2008): 12774-12779, https://doi.org/10.1073/pnas.0806099105.